World

Europes Future | Digital Money & Labor; A Complete Technocracy

Published

8 years agoon

(Via Zerohedge)

The other day I was in a shopping mall looking for an ATM to get some cash. There was no ATM. A week ago, there was still a branch office of a local bank – no more, gone. A Starbucks will replace the space left empty by the bank. I asked around – there will be no more cash automats in this mall – and this pattern is repeated over and over throughout Switzerland and throughout western Europe. Cash machines gradually but ever so faster disappear, not only from shopping malls, also from street corners. Will Switzerland become the first country fully running on digital money?

This new cashless money model is progressively but brutally introduced to the Swiss and Europeans at large – as they are not told what’s really happening behind the scene. If anything, the populace is being told that paying will become much easier. You just swipe your card – and bingo. No more signatures, no more looking for cash machines – your bank account is directly charged for whatever small or large amount you are spending. And naturally and gradually a ‘small fee’ will be introduced by the banks. And you are powerless, as a cash alternative will have been wiped out.

The upwards limit of how much you may charge onto your bank account is mainly set by yourself, as long as it doesn’t exceed the banks tolerance. But the banks’ tolerance is generous. If you exceed your credit, the balance on your account quietly slides into the red and at the end of the month you pay a hefty interest; or interest on unpaid interest – and so on. And that even though interbank interest rates are at a historic low. The Swiss Central Bank’s interest to banks, for example, is even negative; one of the few central banks in the world with negative interest, others include Japan and Denmark.

When I talked recently to the manager of a Geneva bank, he said, it’s getting much worse. ‘We are already closing all bank tellers, and so are most of the other banks’. Which means staff layoffs – which of course makes it only selectively to the news. Bank employees and managers must pass an exam with the Swiss banking commission, for which they have study hundreds of extra hours within a few months to pass a test – usually planned for weekends, so as not to infringe on the banks’ business hours. You got to chances to pass. If you fail you are out, joining the ranks of the unemployed. The trend is similar throughout Europe. The manager didn’t reveal the topic and reason behind the ‘retraining’ – but it became obvious from the ensuing conversation that it had to do with the ‘cashless overtake’ of people by the banks. These are my words, but he, an insider, was as concerned as I, if not more.

Surveillance is everywhere. Now, not only our phone calls and e-mails are spied on, but our bank accounts are too. And what’s worse, with a cashless economy, our accounts are vulnerable to be invaded by the state, by thieves, by the police, by the tax authority, by any kind of authority – and, of course, by the very banks that have had your trust for all your life. Remember the ‘bail-ins’ first tested in early 2013 in Cyprus? – Bail-ins will become common practice for any bank that has abused its greed for profit and would go belly-up, if there wouldn’t be all those deposits from customers. Even shareholders are not safe. This has been quietly decided on some two years ago, both in the US and also by the non-elected white-collar mafia, the European Commission – EC.

The point is, ‘banks über alles’. And which country would be better suited to introduce ‘cashless living’ than Switzerland, the epicenter – along with Wall Street – of international banking. Bank’s will call the shots in the future, on your personal economy and that of the state. They are globalized, following the same principles of deregulation worldwide. They are in collusion with globalized corporations. They will decide whether you eat or become enslaved. They are one of the tree major weapons of the 0.1 % to beat the 99.9% into submission. The other two at the service of the master hegemon’s Full Spectrum Dominance drive, are the war- and security industry and the ever more brazen propaganda lie-machine. Banking deregulation has become another little-propagated rule of the World Trade Organization (WTO). Countries who want to join WTO, must deregulate their banking sector, prying it open for the globalized money-sharks, the Zion-controlled banking conglomerates.

Retrenchment of personnel in the banking employment market is increasing. The news only selectively reports on it, when there are large amounts of jobs being eliminated. Statistics lie everywhere, in the EU as well as in Washington. – Why scare people? They will be scared enough, when they are offered jobs at salaries on which they can barely survive. That’s happening already. It used to be a tactic applied for developing countries: Keep them enslaved by debt and low pay, so they don’t have time and energy to take to the streets to protest – they have to look for food and work, whatever menial jobs they can get, to feed their families. It’s now hitting Europe, the West in general. Some countries way more than Switzerland.

Cashless trials are going on elsewhere, especially in Nordic countries, where selected department stores and supermarkets do no longer take cash. Another monstrous trial has been carried out in India a year ago, in the last quarter of 2016, where from one day to another 80% of the most popular money notes were eliminated, and could only be exchanged for new notes by banks and through bank accounts. And this in an almost pure cash country, where half the population has no bank account, and where remote rural areas have no banks. People were lied to so that the sudden introduction had maximum effect.

It caused massive famine and thousands of people died, as they had suddenly no acceptable cash to buy food – all instigated by the USAID Project ‘Catalyst’, in connivance with the Indian rulers and central bank. It was a trial. It was a disaster. If it works in India with 1.3 billion people, two thirds of whom live in rural areas and most of them have no bank account, the scam could be applied in any developing country – see also India – Crime of the Century – Financial Genocide

What is going on in Switzerland is a trial with the high end of populations. How is the upper crust taking to such radical changes in our daily monetary routine? – So far not many protests have been noticed. There is a weak referendum being launched by a group of people who want the Swiss Central Bank be the only institution that can make money, like in the ‘olden days’. Though a very respectable idea, the referendum has no chance in today’s banking and debt-finance environment, where youth is being indoctrinated with the idea that swiping your card in front of an electronic eye is cool. Today, most money is made by private banks, like elsewhere in Europe and the US. Worldwide banking deregulation, initiated by the Clinton Administration in the 1990s – today a rule for any member of the World Trade Organization (WTO) – has made this all possible.

Digitalization and robotization is just beginning. Staffed check-out counters in supermarkets are dwindling; most of them are automatic – and that happened within the last year. – Where are the employees gone? – I asked an attendant who helped the customers through the self-checkout. ‘They joined the ranks of unemployed’, she said with a sad face, having lost several of her colleagues. ‘It will hit me too, as soon as they don’t need me anymore to show the customers on how to auto-pay.’

Bitcoins

Digitalization also includes the cryptocurrencies, the blockchain moneys floating around – of which the most famous one is Bitcoin. It brings digitalization of money to an apex. The system is complex and seems to lend itself only to ‘experts’. Cryptocurrencies are fiat money, based on nothing, not even on gold. Cryptos are electronic, invisible and highly, but highly speculative, an invitation for gangsters and fraudsters. With extreme speculative values, it looks as if cryptocurrencies were designed for crooks and speculators.

Bitcoin was allegedly invented by Satoshi Nakamoto which could be a pseudonym of a man or a group of people, suspected to live in the US. “Nakamoto’s” identity is believed to be commonwealth origin, due to the vocabulary used in his writings. One of his close associates is purportedly a Swiss coder, who is also an active member of the cryptocurrency community. He is said to have graphed the time stamp of each of Nakamoto’s more than 500 bitcoin forum posts. Such ‘forum posts’ exist in the thousands, worldwide. They form an elaborate network based on algorithms.

Bitcoin was formally created in January 2009 with a fix amount of 21 million ‘coins’, of which more than half are already in circulation, and 1 million, or about 4.75% (of the total) can be traced to Nakamoto – which according to the current market value corresponds to close to US$15 billion. Today’s overall Bitcoin market cap is more than US$ 315 billion. The market is highly volatile. Drastic daily fluctuations are common, especially within the last 12 months. If one of the major Bitcoin holders, like Nakamoto, would capitalize his profit by selling a big portion of his holdings, the Bitcoin price would be in free fall, functioning pretty similar to the regular stock exchange.

On 24 August 2010, when Bitcoin was first traded, its value was US$ 0.06. On 24 December 2017, the coin was worth US$ 13,800, an increase of 230,000%. In the last twelve months, its value increased from about US$ 800 in December 2016 to a peak of close to US$ 20,000 in December 2017, an increase of nearly 2,500 %. However, in the last 7 days, the price has dropped by US$ 5,160, i.e. by more than 27%, and the trend seems to be downward; perhaps a sign of quick profit-taking? However, this shows how instable this cryptocurrency is, apparently much more so than trading corporate shares on the stock market.

The number of cryptocurrencies available over the internet as of 27 November 2017 is above 1300 and growing. A new cryptocurrency can be created at any time and by anyone. By market capitalization, Bitcoin is presently the largest blockchain network (database network, storing data in different publicly verifiable places), followed by Ethereum, Bitcoin Cash, Ripple and Litecoin.

Bitcoin may be the next bubble, bringing down a parallel economy which has already its fingers clawing into our regular western economy. Cryptocurrencies are officially forbidden in Russia and China, though stopping cryptocurrency dealings by individuals is hardly possible. They do not touch the traditional banking system. That’s why major banks hate them. They circumvent the banking suckers, prevent them from making ever higher profits from horrendous commissions, against which the people at large are powerless.

Here is Bitcoin’s positive value. It escapes bank and state controls. If countries’ economies were run on Bitcoins or another cryptocurrency, they would escape US sanctions which function only because western currencies are foster-children of the US-dollar, hence, subject to the dollar hegemony; meaning all international transactions have to pass through a US bank. A typical case is ‘banking blockades’, when Washington decides to stop all international transactions of a country until it submits to the wishes of the empire. It is blackmail; totally illegal, but unless there is a monetary alternative, the (western) world is subject to this system.

A typical case was Argentina, when she was forced by a New York judge in June 2014 to pay a New York based Vulture Fund US$1.6 billion, an illegal ruling according to a UN resolution. Argentina refuse to pay, so the judge, interfering in a sovereign nation, blocked more than US$ 500 million in Argentina’s debt payment to creditors, bringing Argentina to the brink of a second bankruptcy in 13 years. Eventually, neoliberal Macri negotiated a deal with the Vultures of a payment in excess of US$ 400 million.

This US blackmail would not have been possible had Argentina been able to make its foreign transactions in Bitcoins or another cryptocurrency. Venezuela is currently using a national cryptocurrency for some of its foreign transactions, thereby escaping the sanctions stranglehold of Washington. Had Greek and Cyprus citizens had a cryptocurrency alternative to the euro, they would not have been subject to the cash control imposed by the European Central Bank.

On the other hand, funding of terror organizations, like ISIS, cannot be disrupted, if the terror group deals in cryptocurrencies. – This shows, for good or for bad, Bitcoins, or cryptocurrencies are for now unique in resisiting censure and blackmail, or any kind of authoritarian outside interference in electronic money transactions.

Cashless Living

If Switzerland accepts the change to digital money, a country where until relatively recently most people went to pay their monthly bills in cash to the nearest post office – then we, in the western world, are on a fast track to total enslavement by the financial institutions. It goes, of course, hand-in-hand with the rest of systematic and ever faster advancing oppression and robotization of the 99.9% by the 0.1%.

We are currently at cross-roads, where we still can either decide to follow the discourse of a new electronic monetary era, with ever less to say about the product of our work, our money; or whether, We the People, will resist a banking / finance system that has full control over our financial resources, and which can literally starve us into submission or death, if we don’t behave. In order to resist we need an alternative monetary system or monetary network, away from the dollar-euro hegemony.

All the more important is the ascent of another economy, another payment and transfer scheme which already exists in the East, the Chinese International Paymen, totally System (CIPS), effectively a replacement of SWIFT, totally privately run and linked to the US-dollar and US banks. The world needs a multipolar economy, based on the real output of a country or society, as is the case in China and Russia, not one based on fiat money as is the current western economy.

Will Switzerland, the stronghold of world finance, along with New York, London and Hongkong, resist the temptation of increased profit, power and control, offered by digital money? – We, the People, have still the chance to decide either for continuing rotting in a fraud economy, based on wars and greed – for which digital money, exacerbated by cryptocurrencies, is a new tool for a new maximizing profit bonanza on the back of the common people; or do we opt for an honest future and for a life that leaves us free to take sovereign political and monetary decisions in a full cash society. For the latter we must wake up to see the propaganda fraud going on before our eyes, and to resist the robot and electronic money onslaught being unleashed on us.

Today in our current body politic we are inundated with the word FASCIST! The history of the word goes back to the early 20th century with Adolf Hitler and Benito Mussolini. These were fascist dictators. Over the years there was also Saul Alinsky who applied certain tactics to radical left wing activism. Ridiculing someone with fascist and other slanderous put downs were part of the psychological warfare against political opponents. If you are aware of Saul Alinskys’ 13 Rules for Radicals, you will be able to apply it to today’s political discourse. I am a strong believer in knowing your history, helps you understand your present, and enables you to predict the future.

If you follow politics, you will see that some things are done repeatedly from a playbook. These political strategies are used and are tried and true as the Rules for Radicals. These are used over and over because they work, they are successful. When something works you keep using them until they cease to be effective. Certain things can manipulate human behavior and that’s why they are so effective in politics. You are influencing a mass of people, and people like to be accepted into the herd and peer pressure comes into play to make you acquiesce to the current climate. Racism is a great example. No one wants to be called racist. So, calling someone racist puts them on the defensive and isolates them. So, in addition to fascist, racist is used in the left wing demonization of political opponents.

But back to fascism, there are the tell tale signs of political manipulation in today’s political environment. Conservatives will be frequently called far right. They will be frequently called authoritarian. They will also depict deportations as racist and trying to enforce a racial purity. The word autocracy will also be in the pot of slanderous gumbo. Putting all these things together are part of the definition of a FASCIST. This is why those specific words and terms are used over time. These are used to paint a picture of a dictator in the unassuming minds of the public. The word fascist is used deliberately, although in no way shape or form is President Trump a fascist, but reality does not matter in the left’s political world. Another rule for radicals is if you push a negative long enough and hard enough it will break through and be taken as the truth.

Once these rules are recognized you become aware of the manipulation, and this strange political dance becomes increasingly understandable. The ridiculous slander starts to make sense to the political strategist’s mind. I would think why would a person say something so ridiculous, stupid and untrue? Then, when I go back over the Rules for Radicals and communist tactics it makes sense and gives me a much better understanding of the madness.

One of the main rules is: Pick the target, freeze it, personalize it, polarize it.

This is exactly what is being done with Donald Trump. They go after a person, not a corporation. Personalizing it increases the focus on the target unambiguously. Another rule that goes right alongside this is: Ridicule is a man’s best friend. If you are watching the lamestream media (which is dying) you will notice incessant ridicule of the current POTUS. This is by design. This is also why the president has decent poll numbers and not outstanding numbers like he should have that would normally come from his monumental achievements. So, these are many of the reasons that you will see outright lies and vicious slander. It has many functions but all supporting a political slight of hand. Driving a president’s poll numbers down, isolating him, making him toxic, thus degrading his support. This works because many do not pay close attention to the small and /or big lies that are told in the media every day. We must note that there is a method to the madness.

Hillary Clinton was personal friends with Saul Alinsky. She wrote her honors thesis on Saul D. Alinsky. She was not in lock step with all his theories, but he offered her a job while she was in college before she went to Yale University Law School. So, there is ample reason to believe she really took these rules to heart. She served as Secretary of State under President Barack Obama who was a community activist. Community activism was largely based on Saul Alinsky Rules for Radicals. It was to manipulate the public image and opinion on whatever the political issue of the day was. I would ask my Democrat left leaning friends: before Barack Obama was a junior senator from Illinois, what did he do? He was a community organizer or community activist. What did a community organizer do? They generated discord in the community to push for or against a certain political issue. They organized marches and protests. You see the number of protests that are currently happening. Now you understand it is not just for an issue but to get the top news media to get said protest on air to sway public opinion. Visuals are more important than the substance of the march. When these protesters are interviewed many are severely inarticulate and many have only a vague idea of why they are there. But they have the visual and that is the goal. Mission accomplished. The purpose of protests from the left are always the same. But you will see the media will not cover the protests from conservatives in the same way that they cover the protests from leftists. Perfect example let’s take January 6th. The media and the left drone on and on about January 6th like if it were the devil himself had come up straight from hell. And to this day this is the holy grail of leftists’ complaints. One riot. While they ignore the hundreds of riots from BLM, Antifa, Occupy Wall Street and others. Mind you they are responsible for HUNDREDS of riots, billions of dollars of property damage to businesses, hundreds of police injuries, deaths, arson and damage to government property and the attempted murder of police. But they will memory hole all of that and proudly yell, but January 6th though!

Fascism, is used by fascists, to paint their political opponents as such. Projection. Accuse your opponents of what you are doing or are already guilty of. The Democrats demonstrated their hypocritical fascist stance during COVID. Take this shot or lose your job. Close your business or be arrested. You cannot go to church. You cannot visit your elderly relatives in the hospital even if they were dying in hospice. Many lost the last few precious moments with their loved ones because of Democrat Fascist policies. This is what fascism looks like. Lie to the public and tell them you will have immunity once you take the shot. Lie. You cannot transmit the disease once you take the shot. Another lie. We will take two weeks to bend the curve. Lie. We don’t know where the disease came from, BIG LIE! So, when you see the leftists saying something that is demonstrably ludicrous, know they are using their fascist playbook.

Michael Ameer

News@11

BUY NOW – The Black Trump Supporter: The Reawakening Of a Nation

In an unprecedented move, Brazil’s Supreme Court has ordered the nationwide suspension of X, the social media platform formerly known as Twitter, marking a significant escalation in the ongoing feud between the platform’s owner, Elon Musk, and Brazilian authorities. This decision stems from Musk’s refusal to comply with court orders to appoint a legal representative in Brazil and to suspend certain accounts accused of spreading misinformation and hate speech.

The tension reached a boiling point when Justice Alexandre de Moraes gave X a 24-hour ultimatum to name a representative or face a complete operational shutdown in Brazil. Musk’s response was to close X’s office in Brazil, citing threats of arrest against his staff for non-compliance with what he described as “secret censoring orders.” This move has left millions of Brazilian users in the dark, with the platform going offline across the nation.

The implications of this standoff are manifold. Firstly, it pits the concept of free speech, as championed by Musk, against Brazil’s judicial efforts to curb what it sees as the spread of dangerous misinformation. Critics argue that this is a test case for how far nations can go in regulating global digital platforms. Secondly, the economic impact on X cannot be understated, with Brazil being one of its significant markets.

The situation has also sparked a debate on digital sovereignty versus global internet freedom. While some see Justice de Moraes’s actions as necessary to protect Brazilian democracy, others view it as an overreach, potentially stifling free expression. As X users in Brazil scramble to find alternatives or use VPNs to bypass the ban, the world watches closely to see if this could set a precedent for other nations grappling with similar issues.

Media

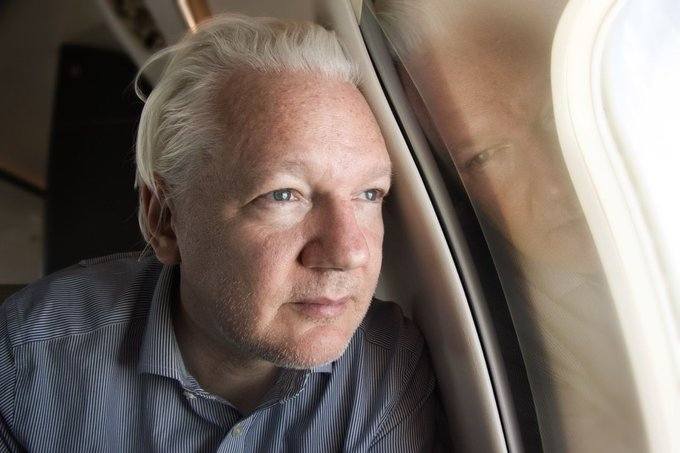

Assange’s Freedom: A Blow to the Neo-Con and Neo-Liberal Elite

Published

2 years agoon

June 25, 2024

In a surprising turn of events, Julian Assange, the controversial founder of WikiLeaks, has been freed from prison, sending shockwaves through the political establishment. For years, Assange has been a thorn in the side of the global elite, exposing their secrets and lies to the world. Now, as he walks free, many on the right-wing populist side of the aisle are celebrating, while others, particularly those with skeletons in their closets, are trembling in fear.

The release of Julian Assange is a victory for truth and transparency. For too long, the powers that be have operated in the shadows, manipulating the masses and advancing their own agendas. Assange and WikiLeaks have been instrumental in shining a light on the dark underbelly of global politics, revealing the corruption and deceit that permeates our institutions.

However, not everyone is happy about Assange’s newfound freedom. Neo-cons and neo-liberals, who have long been in cahoots with the global elite, are terrified that their treasonous activities will be exposed. They fear that Assange’s release will lead to a flood of information that will expose their lies and destroy their carefully constructed narratives.

Take, for example, Mike Pence, the former Vice President of the United States. Pence, a known neo-conservative, has been a vocal opponent of Assange and WikiLeaks. Why? Because he knows that his own treasonous actions could be exposed. Pence has been accused of colluding with foreign powers and selling out the American people for his own gain. The release of Assange could be the final nail in the coffin for Pence and his ilk.

The truth is, the opposition to Assange’s release is not about national security or protecting classified information. It’s about protecting the interests of the global elite and their puppets in government. The neo-cons and neo-liberals are terrified of losing their grip on power, and they will do anything to silence those who threaten their reign.

But the people are waking up. They are tired of being lied to and manipulated. They are hungry for the truth, and they will not be silenced. The release of Julian Assange is a step in the right direction, but it is only the beginning. The fight for truth and transparency is far from over.

As a right-wing populist, I believe that the people have a right to know the truth about their leaders and the institutions that govern them. I believe that the global elite and their puppets in government should be held accountable for their actions. I believe that Julian Assange is a hero, and his release is a victory for the people.

So, to Mike Pence and all the other neo-cons and neo-liberals who oppose Assange’s release, I say this: The truth will come out, and you will be exposed for the traitors that you are. The people will not be silenced, and they will not be fooled. The fight for truth and transparency is just beginning, and we will not rest until justice is served.

Minneapolis: Military is the Only Way

Nick Fuentes: 1 Million Deportations or Bust

RICO in Iowa: Cedar Rapids Lead Map Breaks EPA Rules?

Public Statement from Kristin Mitchell