World

Populism Growing in Europe – Where At Exactly?

Published

8 years agoon

(Via Zerohedge)

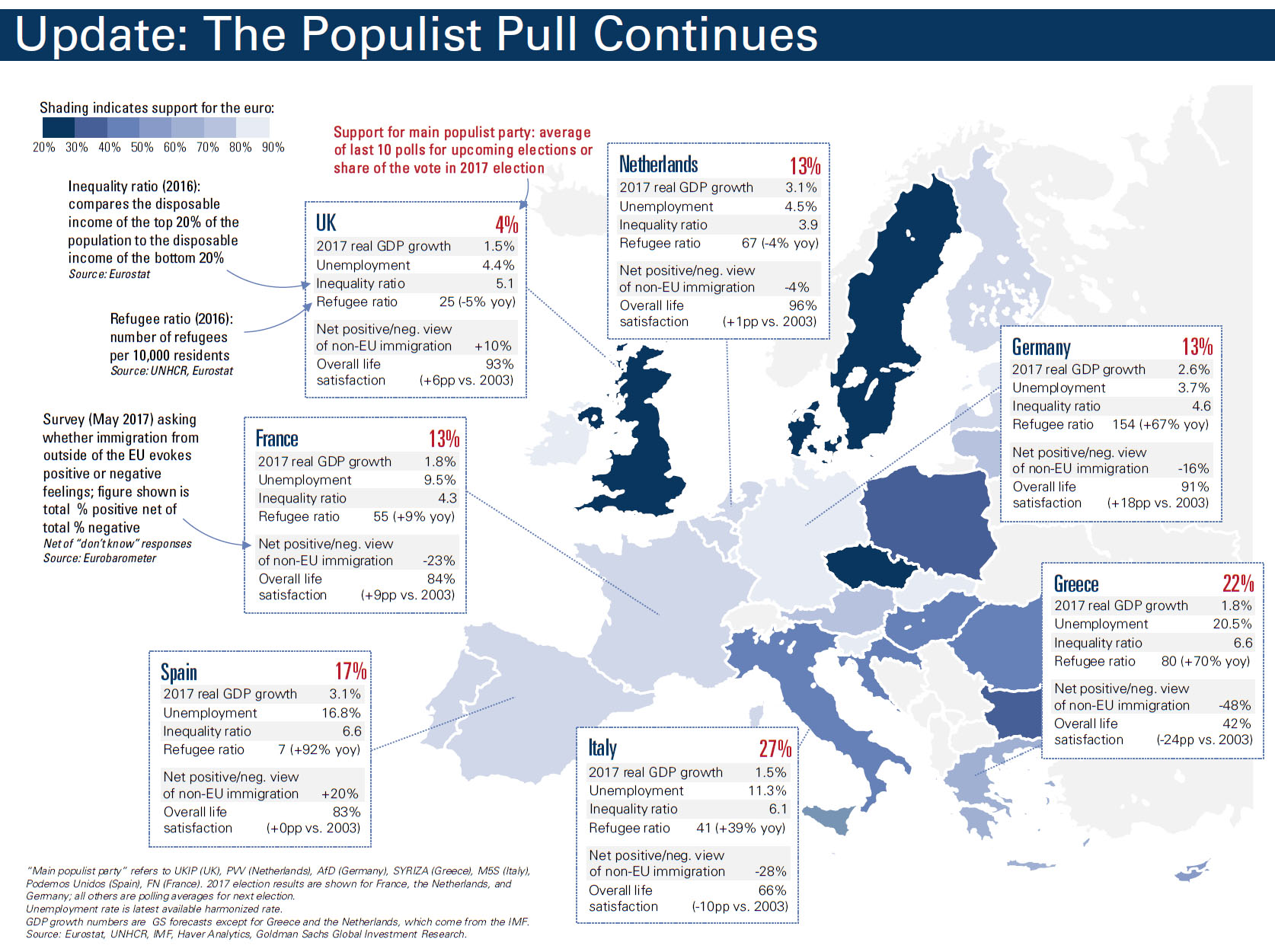

While the establishment may breathe a sigh of relief looking back at political developments and events in Europe – which was spared some of the supposedly “worst-case scenarios” including a Marine le Pen presidency, a Merkel loss and a Geert Wilders victory – in 2017, any victory laps will have to be indefinitely postponed because as Goldman writes in its “Top of Mind” peek at 2018, Europe’s nationalist and populist tide was just resting, and as Pascal Lamy, the former Chief of Staff to the President of the European Commission admitted earlier this year, “Euroskeptic politicians are largely following the pulse of domestic sentiment. The fact is that the public is less enthusiastic about Europe than it once was.”

Echoing the sentiment by the europhile, Goldman’s Allison Nathan writes that while the Euro area’s most immediate political risks—i.e., populist or euroskeptic parties winning key elections this year— did not materialize, these movements have continued to gain traction.

In the Dutch elections in March, the far-right Party for Freedom performed worse than polls had once predicted, but still increased its share of the vote relative to the 2012 elections. It remains the second-largest party in parliament.

In France, concerns about the prospect of Marine Le Pen winning the presidency gave way to optimism over Emmanuel Macron’s reform agenda; nonetheless, Le Pen posted the best-ever showing for her party in a presidential race.

In Germany, Chancellor Angela Merkel’s CDU-CSU retained the largest number of seats in the Bundestag, but the far-right Alternative für Deutschland (AfD) entered it for the first time with 13% of the vote.

And elsewhere in Europe, populist parties on various parts of the political spectrum performed well enough to participate in government coalitions; indeed, an anti-establishment candidate in the Czech Republic recently became prime minister

Some other observations and lessons from recent European events in the twilight days of 2017:

The transition from campaigning to governing has proved difficult. Europe’s increasingly fragmented political landscape has made coalition-building challenging. In the Netherlands, it took over 200 days to form a government with only a single-seat majority. Similarly, German coalition talks with the Green party and the Liberal (FDP) party collapsed in November. But, after having planned to move into the opposition, the SPD—Merkel’s former coalition partner—decided at its congress last week to open talks with the CDU-CSU. Talks were set to begin this week.

Other sources of uncertainty remain unresolved. Spain continues to grapple with the standoff between Madrid and Catalonia; regional elections in Catalonia on December 21 will influence the trajectory of the situation. Meanwhile, the UK and EU-27 seem likely to agree to move past the first phase of the Brexit talks (covering separation issues). But in a setback for UK Prime Minister Theresa May, UK lawmakers recently voted for an amendment to the Brexit bill that will guarantee Parliament a vote on the final deal agreed with the EU.

The decline in political risk bolstered European assets, though fundamentals likely played a decisive role. The market-friendly outcome of the French elections dovetailed with a pick-up in European growth, supporting European equity markets. US inflows into European equities rose significantly but have since stabilized with the acceleration in growth and the decline in the risk premium likely behind us. Receding political risks also contributed to a stronger euro, which is up 12.5% against the dollar this year. Given the currency move, the SXXP is up roughly 7.5% in local terms and 20.6% in USD terms year-to-date.

Next, here’s what Goldman expects and will look for in 2018 and beyond:

A continuation of the populist pull. The socioeconomic and cultural factors driving public opinion are unlikely to dissipate. Indeed, they may come into greater focus if growth moderates on a sequential basis starting in mid-2018.

Constraints to further fiscal integration. Opposition to fiscal transfers within the Euro area makes incremental revisions to existing EU programs more likely than transformational change. Key to watch will be Macron’s credibility as a champion of integration, which will hinge on his ability to push through reforms in the face of political and economic constraints.

Risks around Italian elections set to take place in March. Polls show the largest populist party, the 5 Star Movement (M5S), leading with roughly 27% of the vote. However, the new electoral law and M5S’s unwillingness to join a coalition suggest a centrist coalition is most likely. Such a government, while pro-EU/euro, would likely struggle to implement reforms.

An eventual resolution of political issues in Germany and Spain. We believe Germany’s major parties will work to avoid new elections, given limited public appetite for a new vote and the risk of AfD gaining more seats in parliament. In Spain, economic and policy uncertainty could persist, but in our view, it is not likely to have lasting or systemic implications. Eventually, we expect a compromise that grants Catalonia greater autonomy within Spain.

A bumpy road to Brexit. Expect the UK and EU to eventually agree to a two-year “status quo” transition plan.

And finally, here is a map showing where the forces of populism are expected to remain strong – and grow – across the continent.

Today in our current body politic we are inundated with the word FASCIST! The history of the word goes back to the early 20th century with Adolf Hitler and Benito Mussolini. These were fascist dictators. Over the years there was also Saul Alinsky who applied certain tactics to radical left wing activism. Ridiculing someone with fascist and other slanderous put downs were part of the psychological warfare against political opponents. If you are aware of Saul Alinskys’ 13 Rules for Radicals, you will be able to apply it to today’s political discourse. I am a strong believer in knowing your history, helps you understand your present, and enables you to predict the future.

If you follow politics, you will see that some things are done repeatedly from a playbook. These political strategies are used and are tried and true as the Rules for Radicals. These are used over and over because they work, they are successful. When something works you keep using them until they cease to be effective. Certain things can manipulate human behavior and that’s why they are so effective in politics. You are influencing a mass of people, and people like to be accepted into the herd and peer pressure comes into play to make you acquiesce to the current climate. Racism is a great example. No one wants to be called racist. So, calling someone racist puts them on the defensive and isolates them. So, in addition to fascist, racist is used in the left wing demonization of political opponents.

But back to fascism, there are the tell tale signs of political manipulation in today’s political environment. Conservatives will be frequently called far right. They will be frequently called authoritarian. They will also depict deportations as racist and trying to enforce a racial purity. The word autocracy will also be in the pot of slanderous gumbo. Putting all these things together are part of the definition of a FASCIST. This is why those specific words and terms are used over time. These are used to paint a picture of a dictator in the unassuming minds of the public. The word fascist is used deliberately, although in no way shape or form is President Trump a fascist, but reality does not matter in the left’s political world. Another rule for radicals is if you push a negative long enough and hard enough it will break through and be taken as the truth.

Once these rules are recognized you become aware of the manipulation, and this strange political dance becomes increasingly understandable. The ridiculous slander starts to make sense to the political strategist’s mind. I would think why would a person say something so ridiculous, stupid and untrue? Then, when I go back over the Rules for Radicals and communist tactics it makes sense and gives me a much better understanding of the madness.

One of the main rules is: Pick the target, freeze it, personalize it, polarize it.

This is exactly what is being done with Donald Trump. They go after a person, not a corporation. Personalizing it increases the focus on the target unambiguously. Another rule that goes right alongside this is: Ridicule is a man’s best friend. If you are watching the lamestream media (which is dying) you will notice incessant ridicule of the current POTUS. This is by design. This is also why the president has decent poll numbers and not outstanding numbers like he should have that would normally come from his monumental achievements. So, these are many of the reasons that you will see outright lies and vicious slander. It has many functions but all supporting a political slight of hand. Driving a president’s poll numbers down, isolating him, making him toxic, thus degrading his support. This works because many do not pay close attention to the small and /or big lies that are told in the media every day. We must note that there is a method to the madness.

Hillary Clinton was personal friends with Saul Alinsky. She wrote her honors thesis on Saul D. Alinsky. She was not in lock step with all his theories, but he offered her a job while she was in college before she went to Yale University Law School. So, there is ample reason to believe she really took these rules to heart. She served as Secretary of State under President Barack Obama who was a community activist. Community activism was largely based on Saul Alinsky Rules for Radicals. It was to manipulate the public image and opinion on whatever the political issue of the day was. I would ask my Democrat left leaning friends: before Barack Obama was a junior senator from Illinois, what did he do? He was a community organizer or community activist. What did a community organizer do? They generated discord in the community to push for or against a certain political issue. They organized marches and protests. You see the number of protests that are currently happening. Now you understand it is not just for an issue but to get the top news media to get said protest on air to sway public opinion. Visuals are more important than the substance of the march. When these protesters are interviewed many are severely inarticulate and many have only a vague idea of why they are there. But they have the visual and that is the goal. Mission accomplished. The purpose of protests from the left are always the same. But you will see the media will not cover the protests from conservatives in the same way that they cover the protests from leftists. Perfect example let’s take January 6th. The media and the left drone on and on about January 6th like if it were the devil himself had come up straight from hell. And to this day this is the holy grail of leftists’ complaints. One riot. While they ignore the hundreds of riots from BLM, Antifa, Occupy Wall Street and others. Mind you they are responsible for HUNDREDS of riots, billions of dollars of property damage to businesses, hundreds of police injuries, deaths, arson and damage to government property and the attempted murder of police. But they will memory hole all of that and proudly yell, but January 6th though!

Fascism, is used by fascists, to paint their political opponents as such. Projection. Accuse your opponents of what you are doing or are already guilty of. The Democrats demonstrated their hypocritical fascist stance during COVID. Take this shot or lose your job. Close your business or be arrested. You cannot go to church. You cannot visit your elderly relatives in the hospital even if they were dying in hospice. Many lost the last few precious moments with their loved ones because of Democrat Fascist policies. This is what fascism looks like. Lie to the public and tell them you will have immunity once you take the shot. Lie. You cannot transmit the disease once you take the shot. Another lie. We will take two weeks to bend the curve. Lie. We don’t know where the disease came from, BIG LIE! So, when you see the leftists saying something that is demonstrably ludicrous, know they are using their fascist playbook.

Michael Ameer

News@11

BUY NOW – The Black Trump Supporter: The Reawakening Of a Nation

In an unprecedented move, Brazil’s Supreme Court has ordered the nationwide suspension of X, the social media platform formerly known as Twitter, marking a significant escalation in the ongoing feud between the platform’s owner, Elon Musk, and Brazilian authorities. This decision stems from Musk’s refusal to comply with court orders to appoint a legal representative in Brazil and to suspend certain accounts accused of spreading misinformation and hate speech.

The tension reached a boiling point when Justice Alexandre de Moraes gave X a 24-hour ultimatum to name a representative or face a complete operational shutdown in Brazil. Musk’s response was to close X’s office in Brazil, citing threats of arrest against his staff for non-compliance with what he described as “secret censoring orders.” This move has left millions of Brazilian users in the dark, with the platform going offline across the nation.

The implications of this standoff are manifold. Firstly, it pits the concept of free speech, as championed by Musk, against Brazil’s judicial efforts to curb what it sees as the spread of dangerous misinformation. Critics argue that this is a test case for how far nations can go in regulating global digital platforms. Secondly, the economic impact on X cannot be understated, with Brazil being one of its significant markets.

The situation has also sparked a debate on digital sovereignty versus global internet freedom. While some see Justice de Moraes’s actions as necessary to protect Brazilian democracy, others view it as an overreach, potentially stifling free expression. As X users in Brazil scramble to find alternatives or use VPNs to bypass the ban, the world watches closely to see if this could set a precedent for other nations grappling with similar issues.

Media

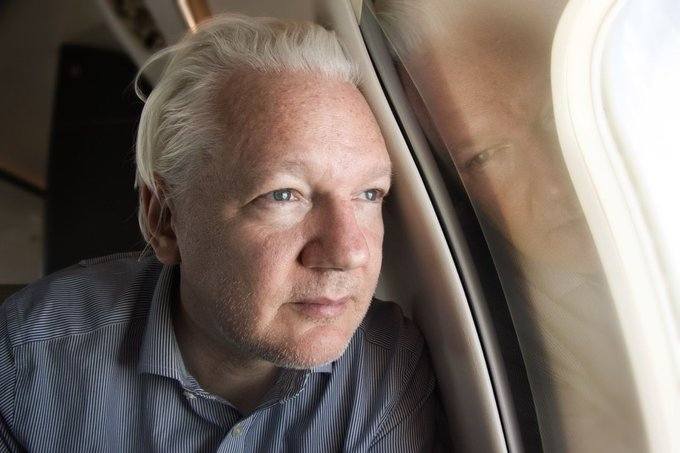

Assange’s Freedom: A Blow to the Neo-Con and Neo-Liberal Elite

Published

2 years agoon

June 25, 2024

In a surprising turn of events, Julian Assange, the controversial founder of WikiLeaks, has been freed from prison, sending shockwaves through the political establishment. For years, Assange has been a thorn in the side of the global elite, exposing their secrets and lies to the world. Now, as he walks free, many on the right-wing populist side of the aisle are celebrating, while others, particularly those with skeletons in their closets, are trembling in fear.

The release of Julian Assange is a victory for truth and transparency. For too long, the powers that be have operated in the shadows, manipulating the masses and advancing their own agendas. Assange and WikiLeaks have been instrumental in shining a light on the dark underbelly of global politics, revealing the corruption and deceit that permeates our institutions.

However, not everyone is happy about Assange’s newfound freedom. Neo-cons and neo-liberals, who have long been in cahoots with the global elite, are terrified that their treasonous activities will be exposed. They fear that Assange’s release will lead to a flood of information that will expose their lies and destroy their carefully constructed narratives.

Take, for example, Mike Pence, the former Vice President of the United States. Pence, a known neo-conservative, has been a vocal opponent of Assange and WikiLeaks. Why? Because he knows that his own treasonous actions could be exposed. Pence has been accused of colluding with foreign powers and selling out the American people for his own gain. The release of Assange could be the final nail in the coffin for Pence and his ilk.

The truth is, the opposition to Assange’s release is not about national security or protecting classified information. It’s about protecting the interests of the global elite and their puppets in government. The neo-cons and neo-liberals are terrified of losing their grip on power, and they will do anything to silence those who threaten their reign.

But the people are waking up. They are tired of being lied to and manipulated. They are hungry for the truth, and they will not be silenced. The release of Julian Assange is a step in the right direction, but it is only the beginning. The fight for truth and transparency is far from over.

As a right-wing populist, I believe that the people have a right to know the truth about their leaders and the institutions that govern them. I believe that the global elite and their puppets in government should be held accountable for their actions. I believe that Julian Assange is a hero, and his release is a victory for the people.

So, to Mike Pence and all the other neo-cons and neo-liberals who oppose Assange’s release, I say this: The truth will come out, and you will be exposed for the traitors that you are. The people will not be silenced, and they will not be fooled. The fight for truth and transparency is just beginning, and we will not rest until justice is served.

Minneapolis: Military is the Only Way

Nick Fuentes: 1 Million Deportations or Bust

RICO in Iowa: Cedar Rapids Lead Map Breaks EPA Rules?

Public Statement from Kristin Mitchell