Politics

New York Gov. Cuomo Propses 17% “Fairness Tax” On Hedge Fund Managers

Published

7 years agoon

(Via Zerohedge)

We suspect Puerto Rico and Miami may be about to see a mass immigration… from New York state…

Never one to miss an opportunity for some virtue-signaling and wealth distribution, New York State Governor Andrew Cuomo announced today, legislation to close carried interest loophole with a so-called “Fairness Fix.”

Under U.S. law, part of income earned by hedge fund managers, private equity investors, venture capitalists and certain real estate investors is known as carried interest and is treated as capital gains, rather than as ordinary income, resulting in lower capital gains tax rates.

This is reportedly costing NY state about $100m/year.

Cuomo proposing legislation treating “this hedge fund compensation” as ordinary income for state tax purposes.

“By imposing a 17 percent “Fairness Fix,” every hedge fund manager working in New York State – including those living outside of the state – will be required to pay their fair share and losses under the federal tax code will be compensated. This proposal could raise nearly $1.1 billion annually and help ease the impacts of the federal tax plan.”

Full Press Release:

GOVERNOR CUOMO ANNOUNCES MAJOR STEP IN CLOSING CARRIED INTEREST LOOPHOLE WITH NEW “FAIRNESS FIX” TO ENSURE JUSTICE FOR NEW YORK TAXPAYERS

Governor’s Proposal Could Raise More Than $1 Billion Annually

Governor Andrew M. Cuomo today announced legislation to close the carried interest loophole, deliver fairness to all New York taxpayers, and help alleviate the impacts of the Trump administration’s federal tax plan. This proposal will fix and equalize the tax treatment of income for private equity investors. Currently, investors pay lower tax rates than ordinary New Yorkers on their income by way of the carried interest loophole. The “Fairness Fix” could raise nearly $1.1 billion annually.

“While the federal government stacks the deck in favor of the wealthy and corporations at the expense of the middle class, we are taking action to protect hardworking New Yorkers and ensure fairness and equality,” Governor Cuomo said.

“Closing this egregious loophole will further this administration’s efforts to promote economic justice and establish a fair tax code for working men and women across New York.”

Under current federal law, a portion of income earned by hedge fund managers, private equity investors, venture capitalists and certain real estate investors – known as carried interest – is treated as capital gains, rather than as ordinary income. As a result, this income is afforded favorable tax treatment in the form of lower capital gains tax rates. This loophole costs the state approximately $100 million every year.

To ensure justice for New York taxpayers and take proactive measures to fight back against the federal government’s tax plan, the Governor has proposed legislation that would treat this hedge fund compensation as ordinary income for state tax purposes. The legislation would also impose a “Fairness Fix” to close the carried interest loophole under New York State’s tax code. By imposing a 17 percent “Fairness Fix,” every hedge fund manager working in New York State – including those living outside of the state – will be required to pay their fair share and losses under the federal tax code will be compensated. This proposal could raise nearly $1.1 billion annually and help ease the impacts of the federal tax plan.

The legislation puts forward a comprehensive, regional approach to addressing the carried interest issue, taking effect only if Connecticut, New Jersey, Massachusetts and Pennsylvania enact legislation having substantially the same effect as this bill.

Governor Cuomo has advocated for hard-working New Yorkers since day one, as Republicans in Washington threaten the economic future of New York State. The Governor has traveled across New York to warn against reforms to the tax code that would increase taxes on New Yorkers by $14.3 billion.

The Governor’s proposal will build on years of action to reduced tax rates for New York’s middle-class to the lowest level in 70 years. In addition, the progressive income tax rate for taxpayers earning over $1 million, which was enacted by the Governor in 2011, will remain in place through 2019.

In 2016, the Governor enacted a multi-billion-dollar tax reduction that will save New York’s middle-class nearly $6.6 billion in just the first four years, with annual savings reaching $4.2 billion by 2025. Over 4 million taxpayers will see an average of $250 in savings next year alone, and $700 annually when fully effective.

While Illinois was the most ditched state in 2017, we wonder if New York will top that list in 2018… on a dollar tax revenue

As we’ve pointed out before, there is a growing wave of domestic migrants that are abandoning over-taxed and generally unaffordable metropolitan areas like San Francisco, New York, Chicago and Miami in search of better lifestyles in the Southeast and Texas.

As we’ve pointed out before, there is a growing wave of domestic migrants that are abandoning over-taxed and generally unaffordable metropolitan areas like San Francisco, New York, Chicago and Miami in search of better lifestyles in the Southeast and Texas.

I. The Early Years: From Procedural Frustration to Claims of Systemic Bias (2007–2016)

Billy Dewayne Frazier IV’s legal saga began in 2007, when he found himself charged in federal court with possessing a handgun whose serial number was partially obliterated. According to the government, the weapon had traveled in interstate commerce, exposing him to a felony conviction. From the start, Frazier insisted the search was improper and that the charges were fabricated to intimidate him for speaking out against police conduct in Marion, Iowa.

He was assigned a federal public defender, Casey Jones, a figure whose name would later reappear across his filings as both counsel and judge. The plea paperwork later produced in court was a chaotic, partially completed draft. It contained visible cross-outs, uninitialed paragraphs, and language waiving post-conviction rights that Frazier asserts he never agreed to. In a supplemental filing years later, he wrote:

“This was never a voluntary plea. It was a threat, wrapped in paperwork they never even finished signing.”

He maintains he was told he faced up to 14 years in prison if he refused. No forensic or fingerprint evidence was ever produced to prove the gun belonged to him, and no chain-of-custody logs were entered in the record.

That 2007 conviction would go on to color every legal proceeding that followed. For years, Frazier describes being branded high-risk based on this record—affecting child welfare cases, bond assessments, and public perceptions.

II. The 2016–2017 DHS and Domestic Cases: A Template for Leverage

By 2016, Frazier had become a familiar figure in Linn County legal circles. His frustration with court practices had escalated, and he began to document what he believed was a system determined to break him. The pivotal moment, he says, came in the form of domestic-related charges and the threatened removal of his children.

He was charged with multiple domestic counts and violations of no-contact orders after trying, he says, to help his wife escape addiction. According to Frazier, these charges were based on minimal evidence—he insists body camera footage clearly showed no assault took place and that his wife herself stated he never touched her.

The key confrontation he describes occurred with Assistant District Attorney Heidi Carmer, now a judge. In a conversation witnessed by his public defender, Nikkidra Tucker, Carmer allegedly delivered an ultimatum:

“She told me, plain as day, that if I didn’t take that plea, I would never see my kids again. That’s not justice—it’s extortion.”

The next day, Frazier was scheduled to regain custody. Faced with that pressure, he accepted the plea. But in 2017, he took DHS to trial over the same allegations and successfully defeated the agency’s attempt to terminate or limit his parental rights—a victory he says was all but ignored in later criminal proceedings.

For Frazier, this episode established a clear pattern: when he refused to cooperate or challenged procedural abuses, prosecutors used DHS as a tool to force compliance.

III. Mounting Documentation and Claims of Retaliation (2017–2023)

After the DHS trial, Frazier returned to a familiar cycle: motions denied without explanation, ADA accommodation requests rejected, and clerks who, in his telling, mishandled filings. By this point, he no longer viewed these incidents as isolated bureaucratic failures.

Instead, he saw them as evidence of coordinated retaliation. In his filings, he described court personnel acting in concert to suppress evidence and obstruct his defense:

“This isn’t just about one arrest or one case. It’s about a pattern that goes back twenty years, and nobody will look at it because they’re all connected.”

During these years, he requested:

- Written instructions because of PTSD and learning disabilities.

- Longer deadlines due to cognitive issues.

- Paper filings to replace online systems he struggled to navigate.

All were denied, he says, reinforcing his conviction that the system viewed him as an irritant to be contained.

IV. April 2024: The OWI Arrest and Immediate Aftermath

The night of April 5, 2024, marked what Frazier describes as the turning point of his legal story. Witness Allen Deschau reported to 911 that a brown Hyundai had drifted over a curb and stopped. Deschau later said he feared the driver was overdosing. Cedar Rapids police arrived to find Frazier behind the wheel.

Officers Mosher, McAtee, and Kuba’s report claimed he smelled of alcohol, had glassy eyes, and refused a breath test. Frazier disputes every point: that he was intoxicated, that he was uncooperative, and that the vehicle stopped for any reason other than mechanical failure.

His handwritten notes on the pre-trial report read like a plea for recognition:

“They knew no children were there, but they did it anyway. They wanted a way to control me while I fought the OWI.”

V. April 26, 2024: Ex Parte DHS Order Without a Case Number

What happened next, he argues, proves his point. According to audit trail records he filed in federal court, ADA Heidi Weiland emailed DHS on April 9, 2024—four days after the arrest. No children were present in the vehicle. No allegations of child endangerment appeared in any police report.

Despite this, an ex parte order dated April 26, 2024, authorized DHS to enter his home and question his children. It listed no juvenile court case number, a procedural omission that, in Frazier’s view, was deliberate:

“This was the setup. No kids were there. This is what they do to retaliate.”

He argues this tactic was identical to what he experienced in 2016—using family leverage to distract and intimidate him as he prepared a legal defense.

VI. March–April 2025: The RICO Complaint and Federal Escalation

By March 2025, Frazier decided no Iowa court would ever impartially consider his evidence. He filed a federal civil RICO complaint in the Northern District of Iowa, naming over 40 defendants. Among them:

- Judge Casey Jones, who had once defended him in the 2007 plea.

- DHS supervisors and caseworkers.

- Linn County prosecutors and clerks.

- Officers from the OWI arrest.

He alleged a coordinated enterprise operating over nearly two decades to obstruct justice, retaliate against protected complaints, and deny his constitutional rights. In his words:

“If the same people I’m accusing are the ones judging me, how could I ever get a fair hearing in this state?”

The complaint demanded over $80 million in damages and the expungement of every conviction tainted by this alleged enterprise.

VII. Recent Developments and Eighth Circuit Appeals (Spring–Summer 2025)

On June 26, 2025, the Linn County District Court dismissed his Petition for Judicial Review, citing a two-day late filing. In doing so, the court rejected all claims of evidence tampering or bias, warning that further unsubstantiated filings could trigger sanctions.

Frazier escalated immediately to the Eighth Circuit Court of Appeals, filing three consolidated appeals. He submitted:

- Motion to Compel Record Transfer.

- Notice of Constitutional Emergency, accusing Judge CJ Williams of retaliation.

- Sworn affidavits describing missing filings, 2AM surveillance noises, and denied ADA accommodations.

- Judicial Misconduct Complaints naming multiple judges.

- Formal declarations about the chain of custody for his evidence.

- Supplemental filings referencing Google reviews and local news coverage as evidence of a broader culture of corruption.

In the coming months, his arguments will test whether the system he describes can, in fact, investigate itself.

VIII. Patterns and Allegations: The Theory of Continuity

Frazier’s filings consistently return to one theme: that these incidents were never isolated. Instead, he argues, they represent a continuum of tactics:

- Threatening to remove children to secure plea agreements.

- Delaying or denying discovery.

- Ignoring ADA requests.

- Refusing recusal motions despite conflicts.

- Leveraging DHS involvement as a parallel pressure mechanism.

He maintains that the same personnel reappear repeatedly, building an unbroken chain of influence and retaliation.

IX. Special Focus: The Use of DHS to Pressure Defendants

For Frazier, no part of this story illustrates the pattern more clearly than the 2016–2017 DHS case and the 2024 ex parte order. In his telling, the identical tactics—using child protective services to extract leverage—prove systemic misconduct.

“First they used my kids in 2016 to make me plead, and then in 2024 they did it again with no reason at all. It’s the same playbook.”

He emphasizes that the 2024 order lacked any case number, preventing him from filing motions to quash or appeal—evidence, he says, that the system was not simply broken but weaponized.

X. What Comes Next

At the time of writing, Frazier’s litigation is pending in multiple venues:

- The Northern District RICO complaint awaits motion practice.

- His §2255 motion to vacate the 2007 conviction is pending.

- A habeas petition remains active.

- The Eighth Circuit has not yet ruled on his emergency motions or appeals.

Frazier has made clear he has no intention of dropping his claims. He has repeatedly said that if federal judges dismiss his filings without a hearing, it will prove his point that no impartial review exists in Iowa.

Conclusion

Billy Frazier’s case is an extraordinary example of a pro se litigant alleging systemic misconduct across nearly every institution that has touched his life. Whether federal courts ultimately credit his claims, they paint a vivid picture of how procedural denials, threats to family integrity, and the power of public institutions can converge on one person.

Politics

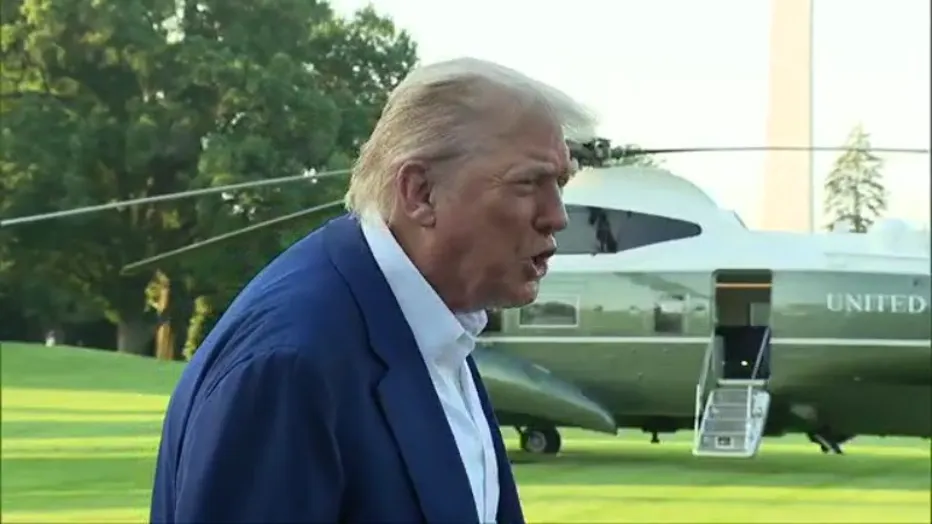

President Donald J. Trump on Israel and Iran: “Two Countries Don’t Know What the F*** They’re Doing.”

Published

2 weeks agoon

June 24, 2025

Trump’s Blunt Rebuke of Israel and Iran: A Strategic Display of Control Amid Ceasefire Chaos

On June 24, 2025, President Donald J. Trump delivered a characteristically unfiltered assessment of the faltering ceasefire between Israel and Iran, declaring, “Two countries don’t know what the f*** they’re doing.” The comment, made to reporters as he departed for a NATO summit, underscored his frustration with both nations for violating a fragile truce brokered just a day earlier on June 23, 2025. Far from a mere outburst, Trump’s statement and the actions surrounding it reveal a calculated approach to reasserting U.S. influence over a volatile Middle East conflict, showcasing his ability to navigate and control a complex geopolitical crisis.

The Context: A Ceasefire Undermined

The ceasefire, intended to de-escalate tensions between Israel and Iran, was a significant diplomatic achievement for the Trump administration, signaling a potential pause in a conflict that has long threatened regional stability. However, within hours, Iran launched a strike that killed several people, prompting Israel to respond with a “symbolic attack” on the same day. These violations unraveled the truce, drawing global attention and risking further escalation, particularly given Iran’s nuclear ambitions and Israel’s military resolve.

Trump’s blunt remark came in response to this rapid deterioration. He expressed particular displeasure with Israel, noting that it “unloaded” on Iran shortly after the agreement, undermining the deal he had championed. “I’m really unhappy with Israel,” he told reporters, a rare public rebuke of a key U.S. ally. Yet, his criticism extended to both parties, reflecting his view that their tit-for-tat actions lacked strategic clarity and jeopardized a cycle of violence.

Why Trump Said It: A Strategic Calculus

Trump’s choice of words was no accident. His provocative language served multiple purposes, each reinforcing his ability to steer the situation:

- Reasserting U.S. Authority: By publicly chastising both Israel and Iran, Trump signaled that the United States, under his leadership, remains the dominant force in Middle East diplomacy. His frustration highlighted the U.S.’s role as the ceasefire’s architect and underscored that violations would not be tolerated without consequences. This move reminded both nations of their reliance on U.S. support—militarily for Israel and diplomatically for Iran in avoiding broader sanctions or isolation.

- Pressuring for Compliance: Trump’s bluntness was a calculated pressure tactic. By calling out Israel’s “unloading” and Iran’s initial strike, he aimed to shame both into reconsidering further violations. His urgent appeal to Israel to avoid additional strikes against Iran, labeling such actions a “serious violation” of the ceasefire, was a direct warning to an ally accustomed to significant autonomy. Similarly, his criticism of Iran’s actions reinforced his earlier stance of giving them “chance after chance” to negotiate, signaling that his patience was not infinite.

- Shaping the Narrative: Trump’s colorful language ensured his message dominated global headlines, keeping the focus on his administration’s efforts to broker peace rather than the ceasefire’s collapse. By framing Israel and Iran as directionless, he positioned himself as the clear-headed leader seeking order amid chaos. This narrative was particularly critical as he headed to the NATO summit, where allies would scrutinize his handling of the crisis.

- Balancing Domestic and International Audiences: Domestically, Trump’s tough talk resonated with his base, who value his no-nonsense style. Internationally, it sent a message to adversaries like Iran that he was not afraid to confront allies like Israel, challenging perceptions of unchecked U.S. support for Israeli actions. This balancing act strengthened his leverage in future negotiations.

Trump’s Control: Actions Speak Louder Than Words

Beyond his rhetoric, Trump demonstrated control through decisive actions that underscored his influence over the situation:

- Direct Diplomacy: Prior to the ceasefire, Trump had privately and publicly urged Israel to refrain from striking Iran, emphasizing his desire for a deal to prevent escalation. Despite Israeli Prime Minister Benjamin Netanyahu’s decision to act, Trump’s ability to extract a ceasefire agreement in the first place showcased his diplomatic clout.

- Public Rebuke as Leverage: By openly criticizing Israel, a move described as a “rare public rebuke of an ally,” Trump shifted the dynamic of U.S.-Israel relations. This signaled to Israel that U.S. support, while steadfast, comes with expectations of compliance with American-led initiatives. It also positioned Trump as a neutral arbiter, increasing his credibility with other regional players.

- Pushing for De-escalation: Trump’s comments were paired with a clear call for negotiations to resume, particularly with Iran, to address its nuclear program and prevent further strikes. His insistence that both nations “don’t know what they’re doing” was a strategic jab to nudge them toward the negotiating table, where the U.S. could dictate terms.

- Navigating NATO and Global Opinion: Departing for the NATO summit, Trump used the crisis to project strength to allies wary of U.S. foreign policy under his second term. His ability to manage the ceasefire’s fallout while engaging with global leaders demonstrated his multitasking prowess and commitment to U.S. leadership on the world stage.

The Bigger Picture: A Pattern of Control

Trump’s handling of the Israel-Iran ceasefire breach aligns with his broader foreign policy approach: bold rhetoric, strategic pressure, and a knack for keeping adversaries and allies alike off balance. His critics, such as those on X who argue he has ceded too much control to Israel, overlook the nuance of his strategy. While Israel’s actions may have tested his influence, Trump’s public frustration and diplomatic maneuvering suggest he is far from a bystander. Instead, he is actively shaping the conflict’s trajectory, using the ceasefire’s collapse as an opportunity to reinforce U.S. dominance.

Conclusion

President Trump’s June 24, 2025, statement that Israel and Iran “don’t know what the f*** they’re doing” was more than a soundbite—it was a calculated move to reassert control over a spiraling Middle East crisis. By leveraging blunt rhetoric, public rebukes, and diplomatic pressure, Trump demonstrated his ability to steer the actions of both allies and adversaries. While the ceasefire’s breach exposed the region’s volatility, Trump’s response showcased his strategic acumen, ensuring the U.S. remains the central player in the quest for stability. As he navigates this crisis, his blend of bravado and pragmatism continues to define his approach, proving that even in chaos, he knows exactly what he’s doing.

Iowa

Chad Pelley Lawsuit in Shambles – Free Speech Win Relieves Bailey Symonds, Strips Injunction

Published

2 months agoon

May 15, 2025

In a pivotal legal ruling issued on May 14, 2025, the Iowa District Court in Linn County struck down nearly all of the speech-restricting injunctions in the high-profile case of Chad Pelley v. Dustin Mazgaj et al. The decision significantly weakens Pelley’s attempt to silence critics through civil court orders—and raises fresh questions about where the case goes from here.

Chad Pelley Injunction Dissolved Bailey Symonds by Populist Wire

Symonds Cleared, Mazgaj Partially Restricted

At the heart of the ruling is a clear rejection of Pelley’s broad effort to restrict speech. The court fully dissolved the injunction against Bailey Symonds, stating that Pelley failed to prove she caused harm or was likely to in the future. As of now, Symonds is under no legal restrictions, restoring her full right to speak about the case, attend public meetings, and post freely online.

In the case of Dustin Mazgaj, who operates under the name Butt Crack News Network, the court issued a narrowed injunction: Mazgaj is now only prohibited from publicly referring to Chad Pelley as a:

- “Pedophile”

- “Drug user”

- “Drug dealer”

All other parts of the injunction—including no-contact orders and broad bans on speech or proximity—were dissolved.

Melissa Duffield Confirmed Unrestricted

The court also clarified that Melissa Duffield, another named defendant, was never placed under an injunction at any point. Attempts by Pelley’s legal team to restrict her speech in a separate post-trial filing were also rejected, with the judge referencing potential First Amendment concerns.

BCNN Not a Company, Just a Username

In a notable clarification, the court determined that Butt Crack News Network is not a separate business or legal entity—it’s simply the name of Mazgaj’s YouTube account. As such, any restrictions on BCNN are effectively just extensions of those on Mazgaj personally.

Skylar Price Still in Limbo

One original defendant, Skylar Price, has not responded to the lawsuit and was found in default. The court did not revisit the injunction as it applies to Price, meaning the original restrictions may still technically be in effect—but without any new legal activity or defense.

Beau Bish and Flex Your Freedoms Not Bound

Though Pelley filed a second motion earlier this year to add Beau Bish and the media group Flex Your Freedoms to the injunction, the court noted that they have not yet been formally served. As a result, they remain unrestricted by the court at this time.

Where Does Pelley’s Case Go From Here?

The judge’s ruling sends a clear signal: courts will not issue broad gag orders unless the speech in question is proven to be false and harmful—and even then, only in narrowly tailored ways.

Pelley may still pursue defamation claims, but without the broad powers of a speech-restricting injunction, he faces a steeper road. The ruling emphasizes the high bar courts place on prior restraint, especially when it involves criticism of someone involved in public matters like real estate development, civic boards, and local politics.

As for the remaining claims—libel, false light, and emotional distress—they will now move toward a full trial. But the public gag orders Pelley once used to silence his critics have been largely rolled back, and the spotlight on his case is only getting brighter.

BREAKING: ‘RICO in Iowa’ Complaint Amended & Filed Under Duress

RICO in Iowa: Will Frazier’s Battle for Justice

President Donald J. Trump on Israel and Iran: “Two Countries Don’t Know What the F*** They’re Doing.”

Chad Pelley Lawsuit in Shambles – Free Speech Win Relieves Bailey Symonds, Strips Injunction